IT IS NOT THE STRONGEST OF THE SPECIES, OR THE MOST INTELLIGENT, THAT SURVIVES, BUT THE MOST ADAPTABLE. – Charles Darwin

For a long time I have felt frustrated by the lack of suitable research to provide guidance when advising clients, particularly retirees, on how to invest their money. There is lots of complex theory, but little practical guidance and little hard practical evidence. What evidence exists is largely directed towards big institutions, with large amounts of money to invest over a very long term.

In 2014 I set out to gather hard evidence about investment performance, to provide better evidence for advising clients in the current climate.

The results were very revealing, and run counter to much currently accepted dogma. In short, it showed that since 1969, there have been at least three major “waves”, with the best investment approach differing greatly between each wave, and what was the best approach in one wave was often disastrous in other waves, and vice versa. The need for flexibility is obvious, and Charles Darwin’s words (above) come to mind.

EVIDENCE

Faced with these dilemmas, in 2014 I commissioned Delta Research and Advisory to construct models that I could then use to provide useful insights, on which to build a hard body of evidence (as distinct from complex theory) to form the basis of suitable investment strategies – especially for people who are retired. In 2015, I then followed up with further model building by Delta.

The approach used was to test is how well the different strategies fared in terms of providing retirees with the income they want. When somebody is drawing on their capital there is reduced margin for error, and mistakes will show up quickly.

2014 MODELS

We modelled a range of portfolios to see how well they delivered the benefits that people wanted, in a range of different start dates.

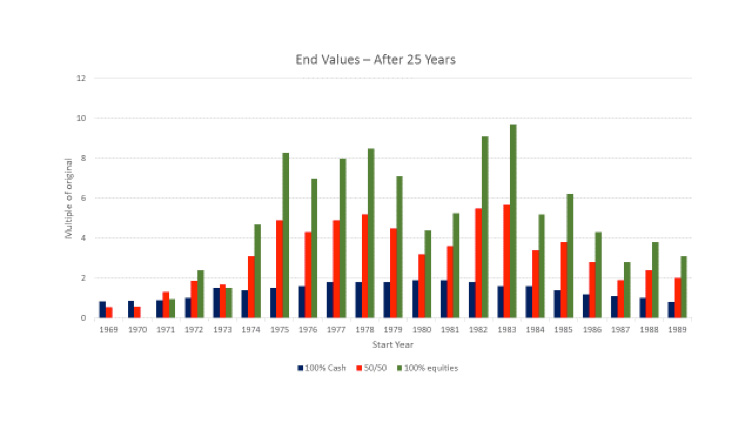

We took a 25 year time frame, to see how portfolio values fared after taking an income of 5% of the starting account balance, with the income adjusted each year for inflation.

The results were astonishing. They showed that how well people retired depended more on when they retired more than anything else – but the obvious catch is that we have little control over the “when”.

The results can be seen in the following bar chart.

Somebody retiring in 1969 or 1970, with all their money in Australian shares would have run out of capital after 15 years. However, somebody retiring in 1983, would have seen their capital grow by almost ten times, in REAL terms (after inflation), and AFTER taking an indexed income.

Somebody retiring in 1969 or 1970, with all their money in Australian shares would have run out of capital after 15 years. However, somebody retiring in 1983, would have seen their capital grow by almost ten times, in REAL terms (after inflation), and AFTER taking an indexed income.

How do we explain these differences??According to some theories, differences of this magnitude should not occur (so much for the theory!). However, one explanation is that there are three distinct waves in the international financial system between the late 1960’s and now. From World War 2 until the early 1970’s, the world-wide financial system was tightly controlled, but this broke down in the early 1970’s and a period of recession, high inflation and high interest rates followed. It was also a period when the financial system was deregulated and the availability of bank loans exploded. Asset values (real estate, shares) rose just about everywhere. Then the period of excessive lending imploded with the GFC, which started in 2007. We are still in the washup of the GFC, and probably will be for some time. Interest rates are at record lows, and look like staying down for years to come – notwithstanding that they may rise slightly. Also, the process of banking re-regulation is ongoing.

LESSONS

So where does this get us, faced as we are with the reality of coming up with investment strategies?

Firstly, there is no “one size fits all” solution. The financial planning industry is littered with pre-packaged solutions. The common approach is to conduct a risk profile of the client, and then recommend an asset allocation based on that. However, the performance of the asset classes varies greatly over time, as the above results show. Any solution must take into account the prevailing economic conditions, and should be flexible enough to change, if economic conditions change.

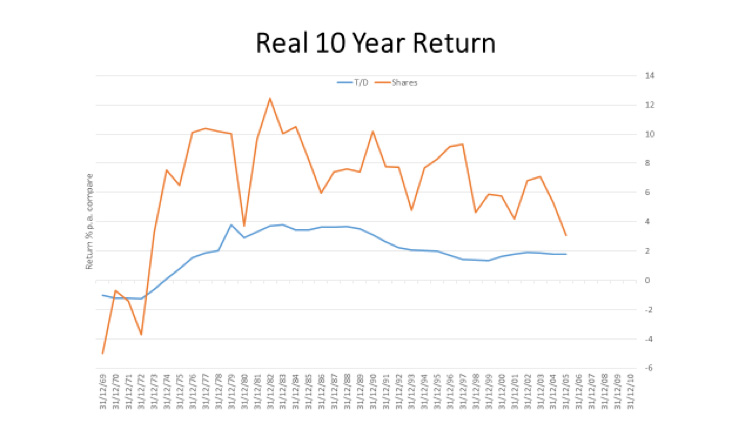

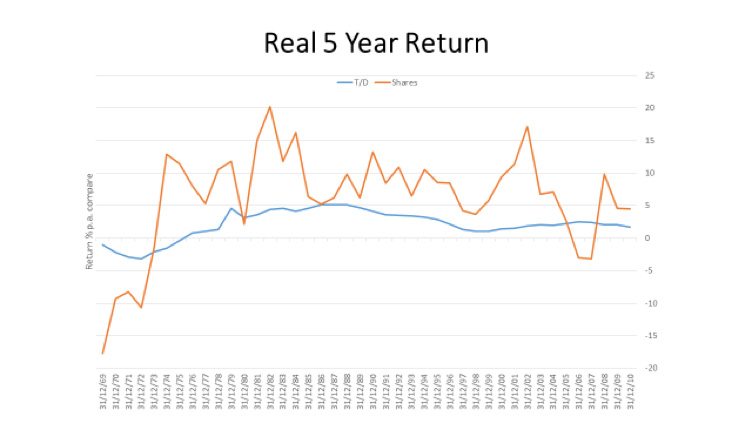

Secondly, time horizon is very important. Most of the packaged solutions look at long term data when building the packages, but for those approaching retirement, or already retired, shorter horizons are better suited, and I have chosen a five year rolling period in several of the charts that follow. Now, I need you to pay attention. The graph immediately below shows that shares are undoubtedly the best long term performer.

But, shares are more volatile, and this is what caught the people who retired in 1969 and 1970, and had all their money in shares. Faced with high inflation, they had to sell down their shares to fund their income. Those who had cash reserves were able to dip into that, and preserve their share portfolio intact for the upswing, when it finally came.

Over rolling five year periods, shares mostly give a superior return, as the graph below shows. The interest rates are annual term deposit rates, and share returns are based on the all ordinaries accumulation index. Dividend Imputation is also accounted for. All results are after allowing for inflation. However, there can be periods of substantial negative returns in shares, which can seriously wound the unwary.

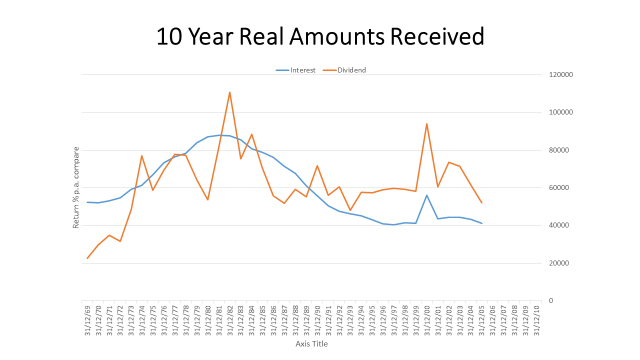

However, shares have two sources of income, capital growth and dividends.

The graph below focuses on dividends. It shows yearly term deposits having a clear lead from 1969 until about 1990 (during that period it was capital growth that gave shares their superior total return). From 1990 until about 1995, it was a much closer contest, and from 1995 until now dividends had a marked advantage except for a brief period after the GFC. I found this surprising. We all know that current franked dividends provide higher income than term deposits. However, I had always thought of this as being a recent thing, whereas it really goes back to the 1990’s.

BUILDING PORTFOLIOS

I always take a portfolio approach when recommending investments for clients.

This approach means diversifying money across different asset classes, and different investments within each asset class. By doing this, we are managing risk, as well as seeking adequate returns. Think of the old, but wise saying, “Don’t put all your eggs in one basket.”

The exact makeup of the portfolio will depend on the client’s circumstances, and current economic conditions. For retirees, and with current economic conditions of modest economic growth and very low interest rates, I adopt a multi-layered approach:

- Layer one contains cash and near cash investments. The interest rate is low, but this layer performs a valuable function as a kind of insurance. If the other investments (see below) suffer falls, then you can draw on the cash to pay your way, and not be forced to sell shares at bargain basement prices. By keeping your shares through the down time, you will be positioned to participate in the recovery, when it comes. Selling your shares at rock bottom prices is a sure fire way to do yourself permanent damage.

- Layer two consists of higher paying income investments. In current conditions, this has a focus on shares paying franked dividends, accessed either by direct ownership or via managed funds. There are specialist managed funds that use a variety of low risk techniques to increase the yield. Current yields are in the range of 7% to 9%.

- Layer three consists of investments that should produce exceptional medium to longer term growth. This involves both direct share ownership and managed funds. When investing in shares, it is the businesses that the relevant companies own that are the real drivers of performance. I thus focus heavily on those fund managers who have superior ability to analyse and understand all aspects of a business, and not focus just on the financial records.

FINALLY

If there are fundamental changes either to the economic situation or the management of companies or Fund Managers, then make necessary changes. I stress the word “fundamental”. Be careful to distinguish between what is fundamental on one hand, and the endless chatter, or gossip or noise that populates the financial world. The chatter, noise and gossip can cause market volatility, but the fundamentals win in the long term.

Having the services of a competent financial advisor, who understands the issues at stake and provides ongoing reviews can provide invaluable assistance.